NEW YORK (AP) — Americans planning for their golden years got a few more grey hairs last week when Washington floated the idea of curtailing the tax-deferred contributions that workers make to their 401(k) accounts. President Donald Trump quickly pushed

NEW YORK (AP) — Americans planning for their golden years got a few more grey hairs last week when Washington floated the idea of curtailing the tax-deferred contributions that workers make to their 401(k) accounts. President Donald Trump quickly pushed back on the possibility, but a key Republican tax cutter responded by saying an adjustment to the 401(k) is still on the table.

The debate raises the question: Just how ready are most Americans for retirement?

Most people will need a combination of savings and Social Security to get by, money they might need to stretch over decades. Some are better able to save before retiring than others. And it’s almost inevitable that as a person ages beyond 65, they’ll pay more for health care.

As Americans await the fate of their 401(k) contributions, here are eight facts to keep in mind about the nation’s retirement readiness:

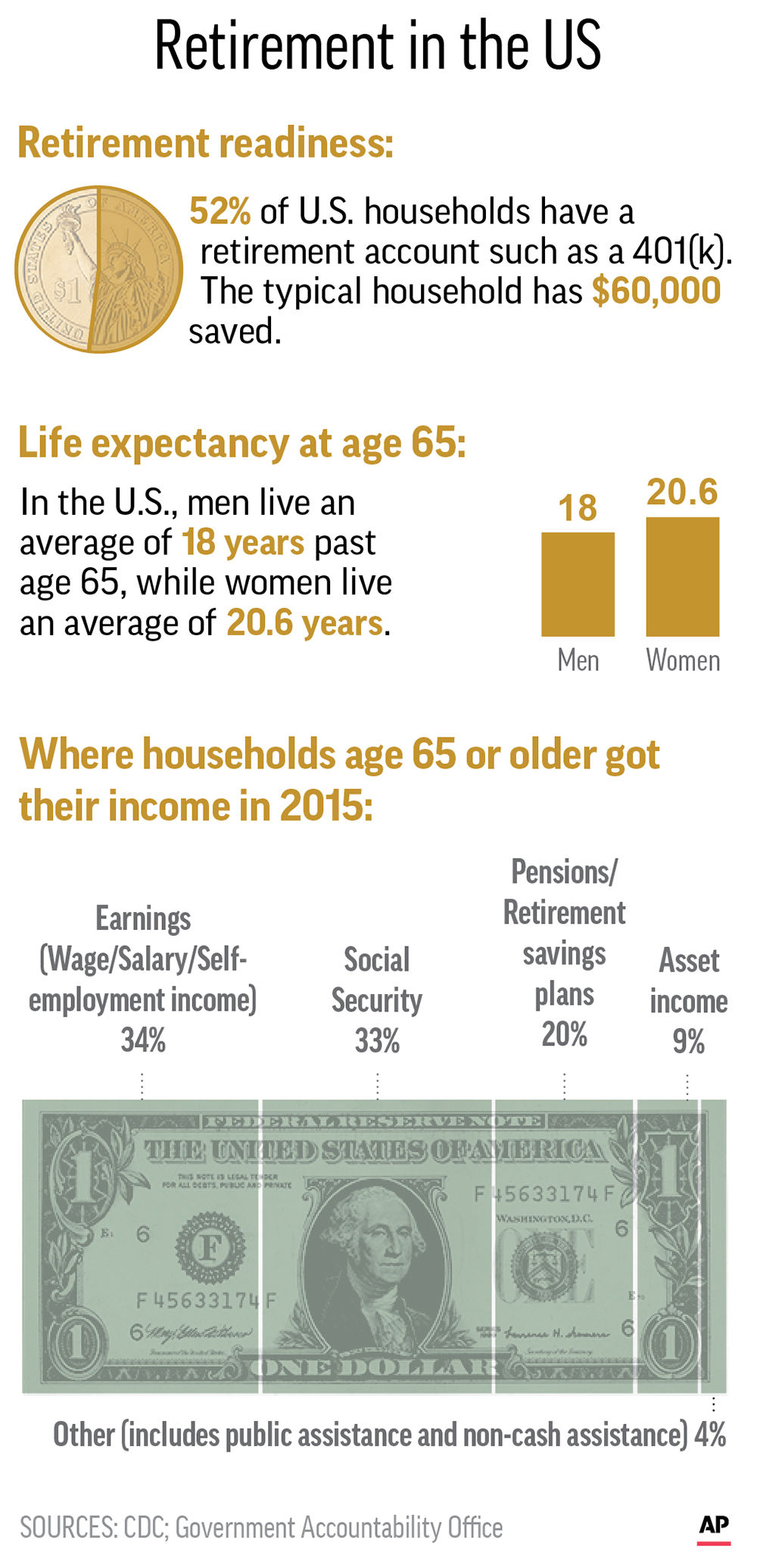

1. A little more than half of America has a retirement account, such as a 401(k) or Individual Retirement Account, according to the Federal Reserve.

2. Not everyone can save in a 401(k), even if they want to, because not all jobs offer one. Only 35 percent of low-income working households had access to a 401(k) or similar plan, according to a recent study by the U.S. Government Accountability Office. For high-income households, meanwhile, it’s 80 percent.

3. The typical household with a retirement account had $60,000 last year, but there’s big variation. Among the top 10 percent of households by income, the typical amount of savings was $403,000. Middle-income households had a median of $25,000.

4. Millennials have more than their parents did at a similar age. The typical household led by someone aged less than 35 with a retirement account had $12,300 last year. In 1989, those same kinds of households had $7,500, after accounting for inflation.

5. The age to get full retirement benefits from Social Security is moving higher. Someone who is 66 years old today can get full benefits. But full-retirement age will move up slowly, beginning with people born in 1955, until it hits 67 for people born in 1960 and later.

6. Retirement can last for decades. Once an American woman gets to 65 years old, life expectancy is an additional 20.6 years, according to the Centers for Disease Control and Prevention. For men, it’s 18 years.

7. Don’t forget about health care costs. A 65-year-old couple will need an estimated $275,000 to cover health care and medical expenses through their retirement, according to Fidelity. That doesn’t include nursing-home or long-term care costs.

8. The traditional corporate pension, where workers get a set amount sent to them through retirement, is disappearing. Only 13 percent of private-sector workers were participating in such a plan in 2014, according to the Employee Benefit Research Institute. In 1979, the rate was nearly triple that, at 38 percent.