HONOLULU — A bill to help Hawai‘i electrical utilities pay for statewide wildfire prevention using low-cost financing has been killed at the state Legislature.

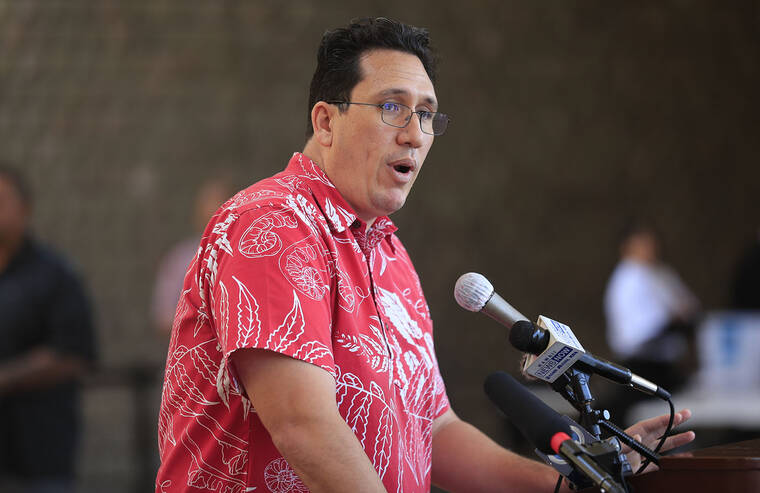

Sen. Jarrett Keohokalole, Senate chair of a conference committee considering a compromise draft on the legislation with House counterparts, deferred any further action on Senate Bill 2922.

The deferral came Thursday after strongly favorable votes in the Senate and House on differing drafts of the bill in March and earlier this month.

A conference committee was formed to discuss a possible final draft of the bill, but some senators were unwilling to do so.

“After careful consideration and consultation with my colleagues, I’m going to recommend that we defer this bill,” said Keohokalole (D, Kaneohe-Kailua). “This decision was not made lightly, and I understand that it may come as a disappointment to many of those who worked tirelessly to advocate for its passage.”

Rep. Linda Ichiyama (D, Fort Shafter Flats-Salt Lake-Pearl Harbor) led the conference committee for the House and told Keohokalole that she was sad over his decision.

“I appreciate your comments,” she said. “I respect your decision.”

Keohokalole said the deferral was done because in his view it is premature to provide what the bill intends regarding financing, and because other things provided for in the bill can be done without the bill becoming law. He also expressed a willingness to reconsider a bill like SB 2922 in the future.

SB 2922 would require Hawaiian Electric and the Kaua‘i Island Utility Cooperative (KIUC) to produce and comply with a risk-based wildfire protection plan approved by the state Public Utilities Commission.

The bill also would allow a utility to sell low-interest bonds secured by rate revenue to pay for plan- implementation costs approved by the PUC under its procedures that include public hearings and input from the state consumer advocate.

Some critics of SB 2922 believed the bill would allow electrical utilities to pass along costs to ratepayers. But this ability already exists, subject to PUC approval. Typically, utility companies are allowed to recover fair and reasonable costs for investments in their systems.

By allowing securitization, meaning low-interest bond financing secured by rate revenue, SB 2922 would benefit ratepayers by lowering the utility’s expense for wildfire prevention that the PUC may allow the utility to recover through higher customer bills.

Hawaiian Electric, which serves about 471,000 customers on O‘ahu, Maui County and Hawai‘i ˆsland, has said approving securitization could raise $2.5 billion and save ratepayers $33 million a year for 30 years.

Currently, Hawaiian Electric faces much higher borrowing costs because the Aug. 8, 2023, wildfires on Maui, which killed 101 people and destroyed most of Lahaina, led to the company’s credit rating being slashed from investment to junk grade as more than 100 lawsuits were filed against the company alleging that power lines downed by extreme winds caused the disaster.

Darren Pai, a spokesperson for Hawaiian Electric, said the company is disappointed with the bill’s demise.

“We laid out an action plan for confronting the threat of wildfire and a way to pay for it at the least cost to customers,” he said in a statement.

“There is still a week to go in the legislative session, and we are engaging with legislative leaders and others to determine a path forward so we can take action now to reduce the risk of wildfire in our state. Ultimately, moving forward without the right solutions in place will result in higher costs for customers and constrain our ability to move quickly to mitigate wildfire risk and advance important safety work.”

KIUC supported SB 2922, but has said that as a nonprofit it has access to financing that is cheaper than securitized bonds.

SB 2922 was proposed by Hawaiian Electric and backed by Gov. Josh Green. The state consumer advocate also expressed support for the bill.

On March 5, the Senate voted 25-0 to send the bill to the House for consideration after holding two public hearings.

The House held three public hearings, and on April 9 voted 41-10 in favor of an amended version of the bill, which included a provision capping the financing cost that the PUC could pass to ratepayers at 5 percent of an average residential monthly bill. The current version of the bill also would not allow Hawaiian Electric to use securitized bond financing to pay for wildfire litigation expenses.

There was an outpouring of opposition to the bill submitted after the last public hearing and before the full House vote. More than 1,200 survivors of the Maui wildfire objected to Hawaiian Electric being able to charge ratepayers for wildfire-related costs.

The flurry of opposition also criticized a similar measure, House Bill 2700, which stalled earlier this month.

Keohokalole, chair of the Senate Commerce and Consumer Protection Committee, which advanced the bill after one of the public hearings, said at Thursday’s meeting that it is premature to commit potentially decades of customer payments toward the facilitation of a wildfire mitigation plan that does not yet exist.

“It will take time to develop a comprehensive plan,” he said. “And the PUC already has the authority to engage in a thoughtful and deliberative process, a public process, to establish that plan.”

Keohokalole also said Hawaiian Electric has various means to fund wildfire mitigation work, including federal grants the company is seeking on top of one grant it has already won.

“As we have been asked not to rush to judgment in the aftermath of the Maui wildfires, it is not prudent for the Legislature to rush to action here when there is still much to be determined with our utilities and our energy future,” he said.

“In closing, this is not a ‘no’ for us on securitization. The recommendation is to defer this measure and work this interim with both of our utilities to further refine and improve this and other measures to ensure that they truly meet the needs of consumers and our broader community.”