A group of 10 farmers got together more than 60 years ago to pool their resources in order to be competitive in their industry.

The meetings resulted not only in the farmers being able to meet the challenges of the pineapple industry, but they became charter members of a credit union that today has five branches across the island and is part of six credit unions on Kauai with total assets of approximately $838,747,475 and membership of nearly 57,000 people.

Credit unions empower people to improve their economic situations in 105 nations around the world at more than 68,000 credit unions that serve the financial needs of 235 million people.

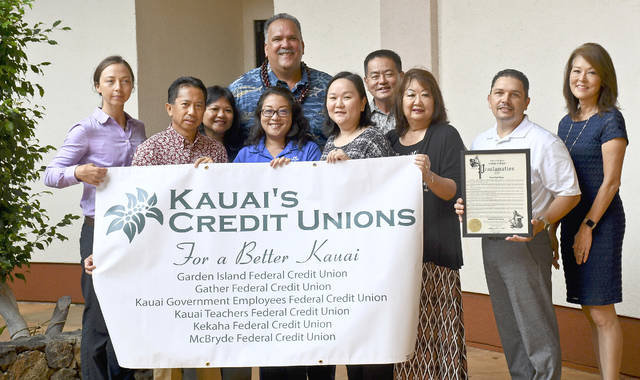

Credit unions have outlived the pineapple and sugar industries, and have grown to include Gather Federal Credit Union, Kauai Government Employees FCU, Garden Island FCU, McBryde FCU, Kauai Teachers FCU and Kekaha FCU that is in the process of becoming a division of Aloha FCU.

These credit unions join the global credit union movement celebrating International Credit Union Week starting Oct. 15 and continuing until Oct. 21, and, more specifically, International Credit Union Day, Oct. 18.

“We have an open house Thursday,” said Flo Tazaki of the Garden Island FCU. “People are able to come in, talk story and have light refreshments to celebrate Credit Union Day.”

The theme of the week and day, “Find Your Platinum Lining in Credit Unions,” combines the traditional gift of platinum for the 70th anniversary, and the play on the saying “find your silver lining” to accentuate the hope members have toward their credit unions. It also illustrates how credit unions and other financial cooperatives serve as catalysts to make different professions, personal choices and career paths a reality, states a proclamation issued by Mayor Bernard Carvalho Jr. that celebrates the event on Kauai.

Credit unions embrace a “people helping people” philosophy through the pooling of personal resources and leadership abilities for the good of the financial cooperative, empowering members to improve their financial futures and uniting to help those in need.

During a recent food drive for the Kauai Independent Food Bank to replenish supplies used for disaster relief from the heavy April rains, the combined credit unions on Kauai surpassed their goal of $20,000 by contributing more than $32,000.

“This was possible because of the efforts from the credit unions’ employees and customers,” said Monica Belz, president and CEO of KGEFCU. “They are all people — people helping other people who need help.”

Through International Credit Union Week and International Credit Union Day, credit unions — which are not-for-profit, democratic financial cooperatives — raise awareness through outreach, volunteering in the community, and more to contribute to the World Council’s Vision 2020 goal of adding 50 million new members by the year 2020.

Tess Shimabukuro, president and CEO for Gather Federal Credit Union, became a credit union member when she needed a student loan.

“My father worked for Lihue Plantation,” Shimabukuro said. “My first membership was with the Lihue Plantation Federal Credit Union that has now become the Garden Island Federal Credit Union.”

Credit unions have demonstrated outstanding leadership through the communities they serve since their founding more than 160 years ago, states the mayoral proclamation. They champion the idea that people from all walks of life should have access to affordable financial services offered by credit unions.

Gather FCU celebrates International Credit Union Day Oct. 18 from 9 a.m. to noon at all of its offices with free refreshments and giveaways while supplies last to demonstrate its appreciation for its customers, and to celebrate what makes them different from other financial institutions, Shimabukuro said.

Has the credit union experience had any impact on your life?

My husband (he was my boyfriend at the time) moved back from Denver, Colorado, nearly 34 years ago. My background was in taxation with a CPA firm, and I had no idea what a credit union was.

I did some research at the Lihue Public Library (there was no Internet back then), and I was a little nervous about working for a not-for-profit organization. Will I get paid?

Mel Chiba (then the president and CEO of Kauai Community Federal Credit Union, which became Gather FCU) hired me as the controller.

Back in the day, that meant you did accounting and whatever else. That was a good thing as I learned more about the credit union industry, and ours in particular. I fell in love with our core mission of “people helping people.”

Today, as I reflect on our founders, it amazes me that 10 pineapple farmers took the initiative to create a financial cooperative that was built on the basis of tanomoshi, a variety of rotating savings and credit associations found in Japan, and making its way to Hawaii with the first Japanese immigrants who came to work on the plantations.

Sixty-four years later, we are still doing what our founders started.

We changed our name to Gather FCU to commemorate our core spirit of how we came to be, and although it was a bold move, we are so pleased to have had so much positive feedback from our members.

How has my experience here impacted my life? I think hanging around for 33 years kind of speaks for itself — you get sucked into the credit union culture without even knowing it. This has been the longest I’ve worked on a job. When I made five years, I asked Mel Chiba if I was going to get a gold watch because I had been there for so long.

I have been blessed to have worked with wonderful people throughout my career here. I truly enjoy coming to work every day because I am always learning something new.

What is the difference between banks and credit unions?

While banks and credit unions are both financial institutions that offer similar services, the main difference between a bank and a credit union is that “customers” of a credit union are members — they own the institution.

A bank is a company, and like most companies, a bank aims to maximize profits for its shareholders.

A credit union if a cooperative that is owned by its members, or customers, who democratically elect a volunteer board of directors. As a not-for-profit untity, any money left over following expenses and reserves is passed back to members in the form of lower fees, lower loan rates, higher deposit yields and free services.

How important is financial literacy, and what are some of the programs being offered to get people more financially literate?

Under the Federal Credit Union Act, promoting financial literacy is a core credit union mission.

Credit unions serve the needs of their members and promote financial literacy with their communities through various channels.

Here at Gather FCU, we have dedicated more resources to providing financial literacy by providing seminars that range from understanding your credit score to seminars on home ownership.

We are launching a new online program that will offer a full menu of topics, and a person can always speak to our loan counselors at our branch offices.

We also have the privilege of educating our youth by working with our schools as well.

Are there any suggestions you might have that would help people become financially secure?

Financial security has a different meaning for different people.

Perhaps starting a conversation with your credit union is a good start. If we cannot provide the resources to fit a person’s needs, we will point you in the right direction.

Do you have any parting thoughts on credit unions?

The credit unions’ history of serving their members is full of stories on how credit unions have helped their members — from the car loan that no one else would give them, helping build budgets to save up for a down payment on a home to improving someone’s credit score to qualify for a loan.

This is demonstrated in this year’s theme of International Credit Union Week and International Credit Union Day in encouraging credit union members to get engaged, share their experiences, and celebrate how credit unions and financial cooperatives have made an impact on their life choices by placing people before profit.

People helping people is more than a philosophy — it’s a way of life.

•••

Dennis Fujimoto, staff writer and photographer, can be reached at 245-0453 or dfujimoto@thegardenisland.com.

I have not met any members who are pleased with the name change to Gather. Rather everyone I have talked to is concerned about the cost of the name change. Also the time it took for making corrections to all the related personal accounts. This was an active topic of conversation while waiting in those long lines at the branches.