WASHINGTON — Determined to protect vital American industries, President Donald Trump declared Thursday that he will impose tariffs on steel and aluminum imports, dramatically raising the possibility of a trade showdown with China and other key trading partners.

The announcement roiled financial markets and stoked fears on Wall Street that other countries could retaliate with trade barriers of their own. At one point Thursday afternoon the Dow Jones industrial average was down more than 500 points, or about 2 percent. The decision also disappointed Republican lawmakers, who warned that it would hurt a range of industries.

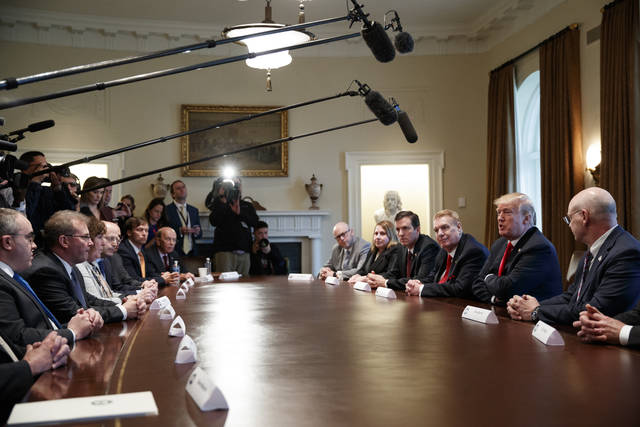

Trump summoned steel and aluminum executives to the White House and told them that next week he would levy penalties of 25 percent on steel and 10 percent on aluminum imports. Those tariffs, he said, will remain for “a long period of time.” But it was not immediately clear if the tariffs would exempt certain trading partners.

“What’s been allowed to go on for decades is disgraceful. It’s disgraceful,” Trump told them in the Cabinet Room. “You will have protection for the first time in a long while and you’re going to regrow your industries.”

Increased foreign production, especially by China, has driven down prices and hurt U.S. producers, creating a situation the Commerce Department calls a national security threat.

Any action to impose tariffs is likely to escalate simmering tensions with China and other U.S. trading partners. Critics of such a move fear that other countries will retaliate or use national security as a pretext to impose trade penalties of their own. They also argue that sanctions on imports will drive up prices and hurt U.S. automakers and other companies that use steel or aluminum.

“This is going to have fallout on our downstream suppliers, particularly in the automotive, machinery and aircraft sectors,” said Wendy Cutler, a former U.S. trade official who is now vice president of the Asia Society Policy Institute. “What benefits one industry can hurt another. What saves one job can jeopardize another.”

Plans for Trump to make an announcement were thrown into doubt earlier because of internal wrangling over the decision. Some White House officials, including chief of staff John Kelly, were not fully briefed on the Commerce Department’s plans, according to a senior administration official familiar with the process. This official was not authorized to discuss the internal deliberations publicly and spoke on condition of anonymity.

The possibility of an announcement, on an issue overseen by Commerce Secretary Wilbur Ross and White House trade adviser Peter Navarro, caught some top White House officials off guard and left several aides scrambling for details.

Key Senate offices also did not receive notice that Trump was expected to announce a decision before April deadlines.

The confusion spread to Wall Street. Shares of U.S. Steel, AK Steel Holding Corp. and Century Aluminum Co. dropped mid-morning on news the announcement had been delayed, then rebounded two hours later after Trump said the tariffs were coming next week.

Trump met more than a dozen executives, including representatives from U.S. Steel Corp., Arcelor Mittal, Nucor, JW Aluminum and Century Aluminum. The industry leaders urged Trump to act, saying they had been unfairly hurt by a glut of imports and foreign countries circumventing trade rules.

“We are not protectionist. We want a level playing field,” said Dave Burritt, president and chief executive officer at U.S. Steel. “It’s for our employees, to support our customers, and when we get this right it will be great for the United States of America. We have to get this done.”

But the announcement was received warily in Congress, with lawmakers raising concern it could launch a trade war that could hurt other industries.

“Every time you do this, you get a retaliation and agriculture is the No. 1 target,” said Sen. Pat Roberts, R-Kan., chairman of the Senate Agriculture Committee. “I think this is terribly counterproductive for the ag economy.”

Said Republican Sen. Orrin Hatch of Utah: “I just don’t think that’s the way to go.”

Trump tweeted earlier Thursday that many U.S industries, including steel and aluminum “have been decimated by decades of unfair trade and bad policy with countries from around the world. We must not let our country, companies and workers be taken advantage of any longer. We want free, fair and SMART TRADE!”

The president had until April 11 to make a decision on steel and until April 19 to decide about aluminum.

The Commerce Department had recommended tariffs on all steel and aluminum imports, higher tariffs on imports from specific countries or a quota on imports.

Ross last month offered the president three options:

—Tariffs of 24 percent on all steel and 7.7 percent on aluminum imports from all countries.

—Tariffs of 53 percent on steel imports from 12 countries, including Brazil, China and Russia, and tariffs of 23.6 percent on aluminum imports from China, Hong Kong, Russia, Venezuela and Vietnam. Under this option, the United States would also impose a quota limiting all other countries to the aluminum and steel they exported to the United States last year.

—A quota on steel and aluminum imports from everywhere, limiting each country to 63 percent of the steel and 86.7 percent of the aluminum they shipped to the U.S. last year.

The Trump administration earlier raised duties on Chinese-made washing machines, solar modules and some aluminum and steel products to offset what it said were improper subsidies.

Trump last year ordered an investigation into whether aluminum and steel imports posed a threat to national defense. Ross said last month that the imports “threaten to impair our national security,” noting, for example, that only one U.S. company now produces a high-quality aluminum alloy needed for military aircraft.

Section 232 of the Trade Expansion Act of 1962 gives the president authority to restrict imports and impose unlimited tariffs if a Commerce Department investigation finds a national security threat.

———

Associated Press writers Zeke Miller, Darlene Superville, Paul Wiseman and Kevin Freking contributed to this report.