An insurance policy offered by the National Rifle Association is under scrutiny by insurance regulators after gun-control groups raised questions about how it’s being marketed. Carry Guard insurance was launched earlier this year by the nation’s most powerful gun lobbying

An insurance policy offered by the National Rifle Association is under scrutiny by insurance regulators after gun-control groups raised questions about how it’s being marketed.

Carry Guard insurance was launched earlier this year by the nation’s most powerful gun lobbying group and is being promoted to gun-owners as needed coverage to help cover civil and criminal legal costs in cases when they shoot someone in self-defense.

Gun-control advocates have called it “murder insurance,” because they believe it would lull gun owners into a false sense of security and encourage them to shoot rather than try to avoid confrontations.

New York state financial regulators have launched an investigation into how it’s being marketed and whether the NRA is illegally receiving commissions without proper licensing.

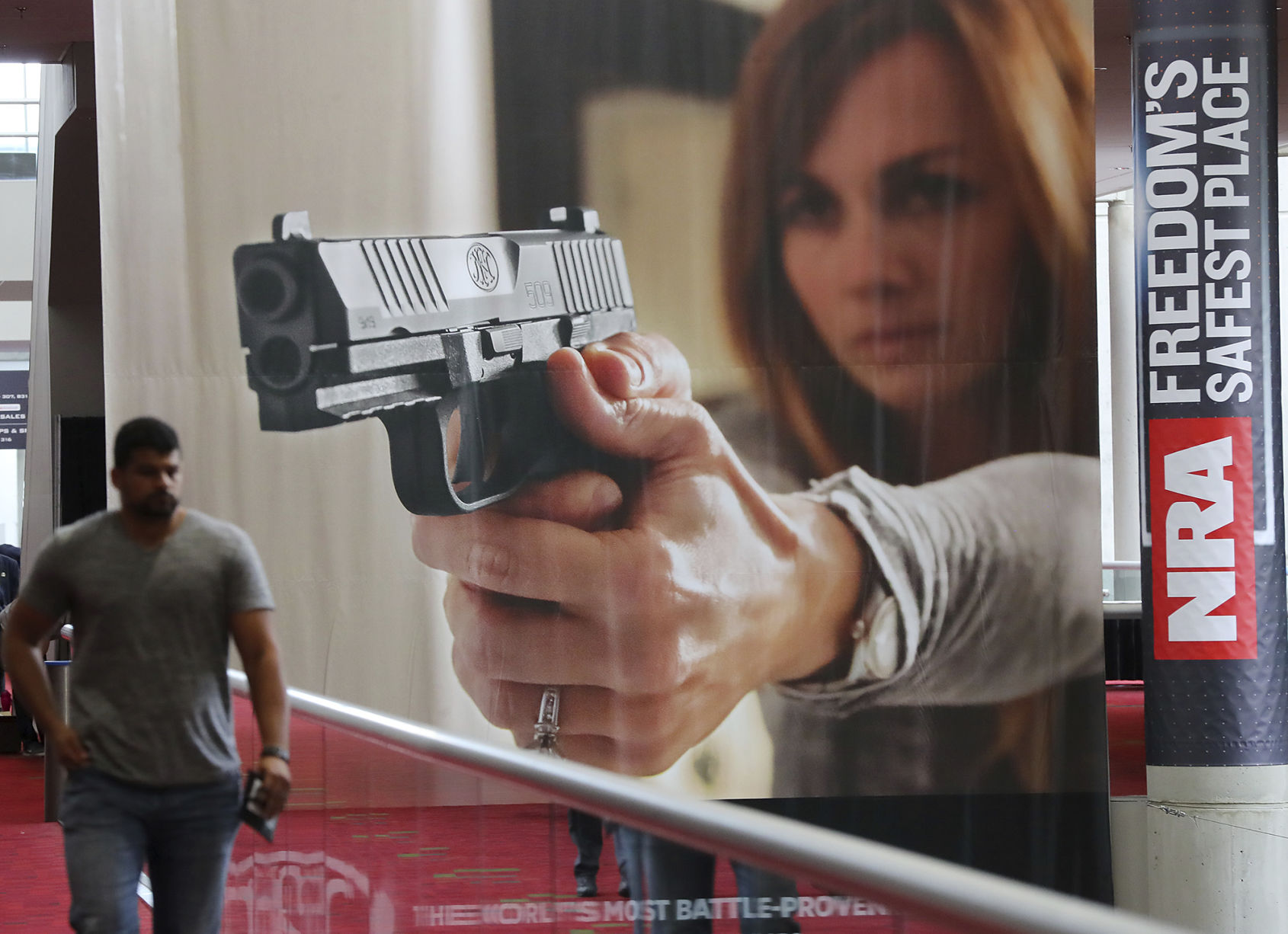

The NRA began heavily promoting the policies at its annual meetings this past spring. Lockton Affinity is the insurance company that administers the policies while Chubb is the underwriter.

Lockton Affinity said in a statement to The Associated Press that it “is cooperating fully with the New York Department of Financial Services about the Carry Guard insurance program. The program is administered by Lockton Affinity, which is properly licensed.” Chubb said in a statement to the AP that it received a letter from New York regulators on Tuesday seeking information and that it would “provide a timely response.”

The NRA did not immediately return a message seeking comment on the inquiry, which was first reported by The Wall Street Journal.

The NRA isn’t the only group that has offered such insurance. The United States Concealed Carry Association has been in the business much longer and provides up to $2 million in civil costs and $250,000 for criminal defense.

But the NRA is the most prominent gun-rights group in the country, and it’s drawing attention to a type of policy that was relatively obscure until now. The NRA offered similar insurance previously, but Carry Guard is more comprehensive and is being marketed more aggressively than in the past.

Carry Guard’s rates range from $13.95 a month for up to $250,000 in civil protection and $50,000 in criminal defense to a “gold plus” policy that costs $49.95 a month and provides up to $1.5 million in civil protection and $250,000 in criminal defense. The coverage kicks in if a court finds the person lawfully shot someone in self-defense or the case is dropped.

Everytown for Gun Safety, an advocacy group, said the probe by New York state regulators followed the group’s own investigation into the policies that it has shared with regulators around the country.

“The New York Department of Financial Services is right to investigate the NRA’s ‘Carry Guard’ insurance,” Everytown’s Eric Tirschwell said in a news release. “Apart from the troubling nature of the product, there are serious legal questions about whether the NRA is violating insurance and possibly other consumer laws, which is why we shared our concerns with law enforcement and regulators.”

Everytown’s legal analysis calls into question the NRA’s marketing tactics and suggests that it may be illegal for an organization to solicit people to purchase the policies unless it is licensed to do so.

“NRA Carry Guard proves that for the NRA’s leadership, no idea is too absurd, reckless or depraved,” said Shannon Watts, founder of the Everytown-affiliated Moms Demand Action For Gun Sense in America. “For years, NRA lobbyists have pushed to allow guns for anyone, anywhere, anytime — no questions asked. Now they’ve figured out how to profit from gun owners concerned about being accused of murder. Carry Guard is just more proof that NRA leaders will do anything for money.”